Table of Contents

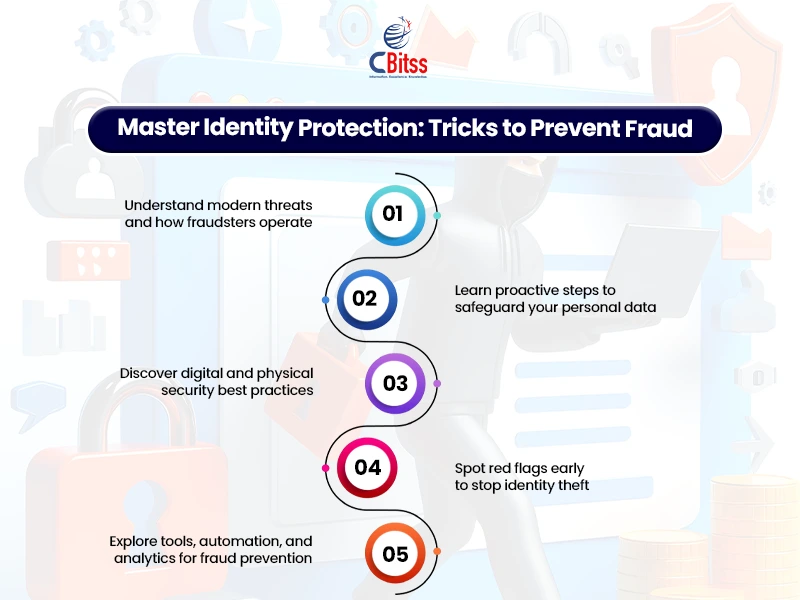

ToggleIntroduction

Have you ever considered that in the modern globalized world, it is so easy to have a stolen identity? Personal information is being transferred through an infinite number of systems daily

through online shopping, to digital banking, and so on. One piece of information on a trick to prevent ID fraud can save you many months of stress and lost money.

Through this article, you will learn how fraudsters work, the weaknesses of people, how to chase fraud prevention phone numbers, and above all, what you can do proactively to safeguard your data before it is too late.

If you’re new to spreadsheets, start by learning what is Microsoft Excel and how it helps in organizing and protecting financial data effectively.

Understanding the Modern Threat Landscape

The idea to prevent ID fraud is much wider than password security. The modern cybercriminals apply advanced techniques to obtain sensitive information with the assistance of phishing letters,

fraudulent websites, and insecure networks. They take advantage of minor flaws, such as passwords that are not very strong or software systems that are not up to date, to initiate massive attacks.

Defense must be on a round-the-clock basis. Any transaction, log in or even filling out online forms can expose information that could be used to steal their identity. Becoming familiar with the operation of these digital schemes will enable you to avoid them beforehand.

Strengthen your analytical skills by discovering how to use Excel for data analysis to detect inconsistencies and prevent fraud patterns early.

The Core of Effective Fraud Prevention

The most important point in any simple steps to protect your identity is the fact that prevention is easier than a cure. After the theft of your information, it may take weeks or even years to reclaim. Powerful prevention measures of fraud would assist you in preventing fraudsters before they begin.

- Multi-factor authentication should always be activated in all accounts.

- Maintain software, browsers, and antivirus software.

- Do not follow the suspicious links or download the unknown attachments.

- Create powerful and different passwords on each platform.

- Look at bank and credit card statements regularly to ensure that there is no unauthorized activity.

- The first and strongest protection against identity theft is regular alertness.

Learn how automation enhances security by exploring what is VBA in Excel for creating custom fraud-checking systems.

Protect your personal data using a reliable and verified prevention approach

Let Us Help You Prevent Identity Fraud

The Role of Financial Institutions

The most important point in any simple steps to protect your identity is the fact that prevention is easier than a cure. After the theft of your information, it may take weeks or even years to reclaim. Powerful prevention measures of fraud would assist you in preventing fraudsters before they begin.

- Multi-factor authentication should always be activated in all accounts.

- Maintain software, browsers, and antivirus software.

- Do not follow the suspicious links or download the unknown attachments.

- Create powerful and different passwords on each platform.

- Look at bank and credit card statements regularly to ensure that there is no unauthorized activity.

- The first and strongest protection against identity theft is regular alertness.

Learn how automation enhances security by exploring what is VBA in Excel for creating custom fraud-checking systems.

How to Prevent Credit Card Fraud?

Credit card theft is one of the crimes that interferes with life. By understanding how to prevent credit card fraud, you are in a position to do your shopping and business transactions without any fear. Most criminals will steal card information on ATMs, open Wi-Fi networks, or unsecured websites.

- Shop only on secure sites (HTTPS).

- Use a temporary or virtual credit card number as much as possible.

- Do not save payment information on browsers or unverified applications.

- Check your credit report regularly.

- Notify your bank about any suspicious transactions.

A single accidental click can reveal financial information, so develop practices that will ensure data security is automatic. Learning how to chase fraud prevention numbers can also be a good thing to consider.

Take your technical skills further with an advanced Excel course online to manage business data more securely and efficiently.

Learn how to control access to your identity and prevent misuse

Spotting Red Flags Early

There is no guarantee of what can be done to your data, but you can decide how quickly you will react. The identification of red flags is a crucial trick to prevent ID fraud. Strange credit checks, unaccounted account freezes, or unexpected address changes are the indicators that a person might be misusing your identity.

Before committing a big transaction, fraudsters usually use the stolen credentials in small purchases. In order to detect these early warning signs before it is too late, you should check your financial activity at least once a week. An identity thief can be prevented quickly before he/she control your accounts.

Explore how integration works by learning how to use Power BI with Excel to visualize trends and spot potential fraud indicators.

Combining Digital and Physical Security

The largest error that individuals commit is believing that they will be safe with just digital security. Online safety is used alongside real-world vigilance in any powerful way to prevent fraud.

- Tear and cut the documents with personal information, and then dispose of them.

- Store IDs, passports, and bank statements somewhere safe.

- Take care to be careful not to share personal information either on the phone or in person.

- Secure your mail through lockable mailboxes or online statements.

- Do not leave gadgets unattended in open places.

The hybrid approach of both digital and physical protection would make your overall security stronger and less prone to the disclosure of personal data.

Gain insights into the future of accounting and understand how automation and digital tools will enhance fraud prevention in finance.

How to Prevent Fraud in Business Settings?

The risk to businesses is all the more because they hold several layers of personal and financial information. Educating oneself on how to prevent fraud in corporate settings helps ensure that the customers and the assets of the company are not at risk.

The organizations are to invest in cybersecurity training, establish stringent data access control measures, and conduct regular audits. AI-powered systems detect fraud in real-time.

Training of employees on phishing, ransomware, and insider threats also helps in making the whole organization work towards security. Acquisition of a culture that is conscious of fraud makes all tiers of business guarded against identity theft and financial manipulation.

The Importance of Awareness and Education

Awareness is the least-known trick to prevent ID fraud. There is also the assistance of technology, and your choices are your most powerful line of defense. Education on digital hygiene, passwords, and privacy policies that are communicated to the populace contributes immensely to the decreased success of fraud.

The new tricks of criminals can be updated through workshops, online tutorials, and fraud warnings from official agencies, such as the FTC or USA.gov. Being educated means that you adapt to the evolving environment of threats and you are not the next victim.

Preparing for the Future of Fraud Defense

Cybercrime evolves continuously, and thus, old-fashioned defenses are no use. The future fraud prevention systems will include a greater role played by artificial intelligence, biometrics, and blockchain. These technologies identify identity in stronger ways and reduce the amount of data exposure.

The banks, governments, and private companies are already considering using predictive analytics to identify fraud before it occurs. In the case of individuals, it means that we need to become smarter and make safe transactions through the use of technology. Through innovation, you have one step over identity thieves and are not chasing them after they have caused harm.

Get Personalized Support for Identity Protection

Conclusion

At this point, the message behind Trick to Prevent ID Fraud is clear: protection begins with awareness and consistent action. Whether it’s learning how to prevent credit card fraud, chase fraud prevention numbers, understanding how to prevent fraud in business, or using trusted channels like the Chase fraud prevention phone number, the key is to stay proactive.

The best thing you have is who you are, and protecting it has to be part of your routine. By having the correct mixture of technology, education, and vigilance, you are free to enjoy the digital world with confidence.

Familiarize yourself with MYOB accounting software to streamline your bookkeeping and minimize manual data errors.

Take control of your digital safety today. Look through your records, change your passwords, and forward this information to relatives and colleagues.

Begin implementing this trick to prevent ID fraud before fraudsters attack. Your consciousness is your best defense.

Apply it to safeguard the best.

If you’re planning a career in finance, consider a diploma in accounting and finance in Chandigarh to build professional expertise in fraud detection and financial management.

Sukhamrit Kaur is an SEO writer who loves simplifying complex topics. She has helped companies like Data World, DataCamp, and Rask AI create engaging and informative content for their audiences. You can connect with her on LinkedIn.