Table of Contents

ToggleWhat is a profit and loss statement? This is a question many people ask. To put simply, it is a financial statement indicating the revenues, costs, and net profits of a company within a given period. It provides a brief overview of the financial performance of a business and whether it is making profits or making losses.

This statement is useful to businesses, investors, and lenders because they can see the degree of profitability and sustainability. A profit and loss statement template or a sample profit and loss statement is used by many companies to ensure things are straight and above board. It is also easier to track and forecast in real time using modern tools today.

Reading this article, you will know what is a profit and loss statement and how it works, and why it is important. You will also know how to define and utilize one successfully, so by the end, you will be confident enough to demonstrate how businesses gauge their success using this significant financial instrument.

Defining a Profit and Loss Statement

A statement will monitor the income gained, the costs incurred, and the final result. It enables the owners of businesses to determine profitable and unprofitable areas.

Key components include:

Revenue

Revenue is defined as the money earned by a business through the sale of goods or services. It is the initial indicator of financial performance, and it forms the initial line of any statement. Constant or growing revenue base that the business is making sales, and people are coming.

Expenses

Expenses are all the costs of operations, administration, and production required by a business to remain in business. These can be salaries, rent, utilities, raw materials, etc., depending on the nature of the business; close scrutiny of the expenses would result in appropriate calculation of the profitability and could identify areas where the costs could be reduced.

Gross Profit

The gross profit will be the difference between the total revenue and the cost of goods sold (COGS). It is also employed in making decisions about how efficient a business is in manufacturing and selling goods or services without considering any other expenses. A high gross profit is one of the ways that the company is performing its production and pricing policies.

Net Profit

The difference between the total revenue and all the expenses, taxes, and interest taken away is the net profit. It is also called the bottom line because it shows the real profitability of a business. High levels of net profit indicate financial health and the ability to reinvest, grow, or pay back stockholders.

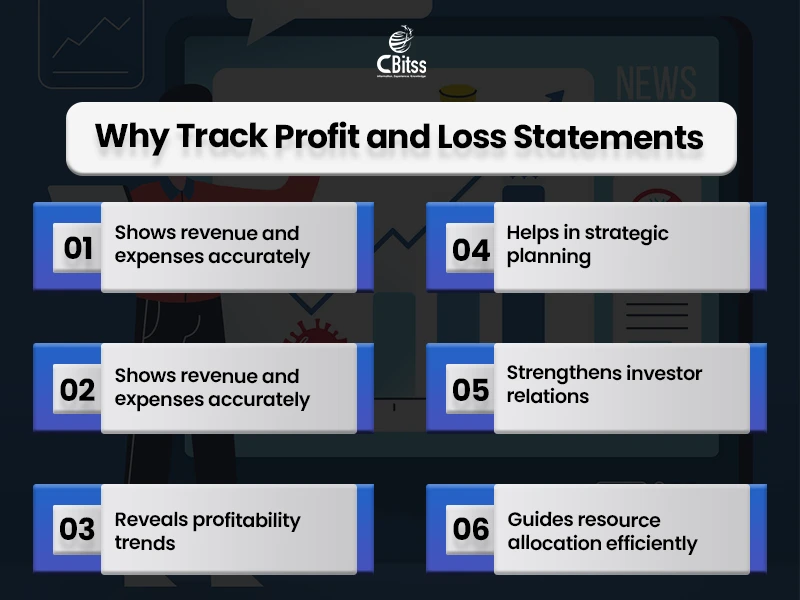

Benefits of a Profit and Loss Statement

A statement provides critical insights for business strategy.

Key Advantages:

- Shows the real-time financial performance to make useful decisions.

- Wants to find opportunities to save costs and improve efficiency.

- Facilitates tax compliance and regulatory reporting.

- Leads investors and lenders through the example of profitability.

- Supports budgeting, forecasting, and financial planning.

- Enhances cash flow management through the display of the timing of the income and expenditures.

- Helps assess the effects of doing or investing in something new.

- Provides documents to acquire loans, grants, or outside funding.

Components Explained

| Component | Description |

| Revenue | Total income from sales or services |

| Cost of Goods Sold | Direct Costs Cost of Goods Sold: Materials and Labor |

| Gross Profit | Gross Profit Revenue-COGS. |

| Operating Expenses | Overhead, salaries, marketing, utilities |

| Net Profit | Profit remaining after all deductions |

These components are what enable us to interpret a profit and loss statement example properly.

Types of Profit and Loss Statement Templates

There are various templates that businesses utilise in accordance with their size, industry, and reporting requirements.

Simple:

This is a simple layout that displays the revenue and expenses in a simple manner. It is not technical and is simple to follow. It best suits small businesses or startups that do not require venturing into the specifics of the profit breakdown to get a rough picture.

Detailed:

This template contains a more detailed breakdown that has numerous categories of costs, including salaries, utilities, rent, and marketing. Mid-sized businesses that need to have a better understanding of the impacts of various costs on profitability typically use it.

Sector-Specific:

It is a specialized form that is industry-specific: retail, manufacturing, or services. Further, it points out costs and sources of revenues peculiar to individual sectors. It suits best when a company has to be compliant with the requirements of the business industry or in the sector analysis. Templates make it easier to prepare and help minimize errors in reporting.

How to Prepare These Statements?

Step-by-step preparation ensures accuracy and reliability:

- Firstly, the list records all revenue collected from sales or services, and therefore it clearly reflects the total amount of revenue earned.

- Any expenditure, operational, or administrative cost must be tracked to account for all costs. Gross profit = Revenue- estimated cost of goods sold.

- The net profit is obtained by subtracting operating expenses, taxes, and interest.

- Compare bank accounts with missing information.

- Line-item budgeting (e.g., payroll, rent, marketing): identify and classify costs and determine the most significant drivers of costs.

- Include non-operating income or expenses, such as investment gains or losses, for a complete picture.

Tips for accuracy:

- Backlog avoidance via record keeping.

- Use digital software for automated calculation.

- Maintain consistency with your template.

- Compare with the past to trace the growth and to identify Trends.

- Check the entries twice, not to make an error when reporting.

Explore step-by-step training on financial statements with our accounting experts in Chandigarh.

Start Your Accounting Journey – Fill the Form Below

Also Read -

Profit and Loss Statement Example

To understand better, here is a simple profit and loss statement example for a small business over one Month.

One month, a small business earned a revenue of INR 50,000. The retail price of goods sold amounted to 20,000, and the gross profit was 30,000. The business earned a net profit of 20,000 after all it covered operating costs of 10,000; therefore, it achieved strong financial performance.

This basic statement actively illustrates the calculation of gross and net profits; therefore, it can extend into an annual report and, in addition, into a departmental analysis as well.

Using a Sample Profit and Loss Statement

These statements help businesses plan and forecast effectively.

Monthly vs Annual Statements

Monthly: A monthly statement provides a short-term performance review, and it can help us track trends as they occur. It enables business owners to notice an issue such as rising expenses or declining sales early, before it becomes a big problem. Moreover, monthly statements actively facilitate cash flow management, and therefore the income matches the expenses. Moreover, managers actively vary strategies in the short run; for example, they reduce costs, increase marketing, or reallocate resources.

Annual: An annual statement, in turn, gives us the big picture of the financial health. It is significant for budgeting, tax, and long-term strategic planning. The annual statements help to determine how successful the business is in achieving its annual goals and provide a vision of the business’s profitability. They can also assist external parties, such as an investor, a lender, or a regulator, who consider a company through its year-end financial statements to make judgments. Businesses can easily adjust these templates to suit their reporting frequency and business requirements. Moreover, they remain flexible and, therefore, adaptable to different needs.

Stay ahead of the curve by learning AI-powered

Future Trends in Profit and Loss Statements

Technology and business complexity actively drive the evolution of statements; moreover, they continuously shape it further.

- Automation: Moreover, the software creates statements in seconds; as a result, it saves time and minimizes mistakes. This aspect improves the effectiveness of this process. It automatically updates the data to keep the accuracy.

- AI Forecasting: AI applications actively forecast future revenue, cost, and profit trends by analyzing previous data; moreover, they provide predictions that, therefore, support better decision-making. It gives a business a better approach to future planning.

- Cloud Accounting: Cloud accounting supports remote teamwork with accountants or other team members by using cloud services. They also provide the security of the data and backup.

- Real-Time Analysis: With the help of the real-time tools, it is possible to obtain information about the financial performance. This helps businesses to make more effective and intelligent decisions.

- Visualization Tools: Graphing and visualization tools actively transform numbers into graphic images; therefore, they make data easier to understand. In addition, these tools enhance analysis by presenting clear visual patterns. This makes the understanding of financial reports easier.

Get Free Counseling on Profit and Loss Statements

Conclusion

So, what is a profit and loss statement? It is a fundamental financial report assessing performance, costs, and profitability. Moreover, it incorporates any business-related expenses. It also offers insights that help management and increase investor confidence and regulatory compliance. A good statement clearly shows how efficient a business is, and moreover, it highlights where development still needs improvement.

A profit and loss statement template or sample will also prevent any errors in different periods of reporting. There is also the advantage of using templates to prepare documents.

In fact, digital tools now provide these statements in real time, and they automate processes while predicting outcomes; as a result, the reports become both faster and smarter. The development of technologies like AI and cloud technology is useful because it allows companies to become strategic partners through optimized reporting.

Want to master accounting and finance, and take control of your profit and loss statement?

Ready to boost your skills and make smarter business decisions?

Enroll in our accounting and finance courses today, and start building the expertise that sets you apart.

Sukhamrit Kaur

Sukhamrit Kaur is an SEO writer who loves simplifying complex topics. She has helped companies like Data World, DataCamp, and Rask AI create engaging and informative content for their audiences. You can connect with her on LinkedIn.